Recent ban on wheat export has come as a jolt for

traders and farmers. The decision was taken under the purview of India’s food

security concerns, in the wake of the sudden hike in domestic prices,

Government decided to ban export of wheat.

Later the ban was relaxed to accommodate genuine

wheat export contracts backed by SWIFT certified LCs established before the ban

kicked in. Euphoria among farmers to have received prices well above MSP for

the first time in many years soon evaporated.

One of the stated reasons for export restrictions is

lower expected production during 2021-22 season because of unusually hot

temperature in Feb-Mar 2022.

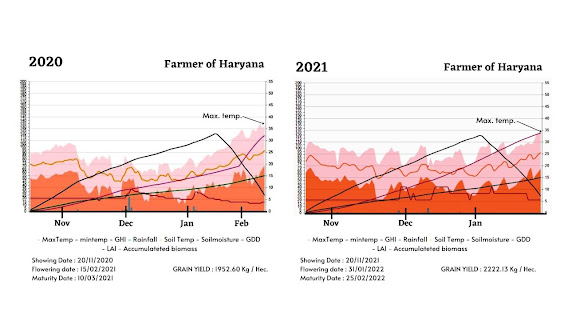

We BKC set out to analyze the losses in yield

because of hot weather.

We BKC are connected with farmers in one-to-one

basis through our App Fasal Salah for day-to-day advisories. We also run crop

model for their crop which calculates expected yield in run time from sowing until

harvest. We ran sample analysis for over hundred farmers and found no evidence

of yield loss on account of hot weather during maturity in all major producing

states of Uttar Pradesh, Haryana and Madhya Pradesh.

Analyzed yield for some sample farmers can be seen as under.

Therefore, the general conclusion being drawn that

heat wave has affected the crop yield does not seem to be a correct conclusion.

Farmers seem most affected by sudden ban on wheat

exports. Prices in local mandis have declined a bit but still holding firm as

market arrivals are lower. Farmers are continuously watching the Stop-Go

situation to sell their produce in the market. Generally, they are holding the

stock in hope that prices will rise in the future. But the decision to stop

wheat export suddenly seems to be hurting wheat farmers and has put exporters

having firm export contracts under stress as well.

Talking about the procurement by FCI, it has set the

deadline to 31st May in various mandis to complete the procurement

and may extend the deadline if the procurement goal is not met.

A number of traders and exporters are facing

problems of cancellation of their orders on mandis while Govt. of India has

initiated action against exporters whose export orders are supported by bogus

LCs at the same time.

Both farmers and exporters seem to be losers.

.jpeg)

.jpeg)

Intersting observations by BKS and RS. Is it possible to publish your observations in a peer reviewed scientific journal? Public could get confused over claims and counter claims. We have a responsibility to convey authentic message on the effect of the current heat wave on wheat yields in the NW India.

ReplyDeleteImpressive and powerful suggestion by the author of this blog are really helpful to me. Best Cfd Brokers Uk

ReplyDelete